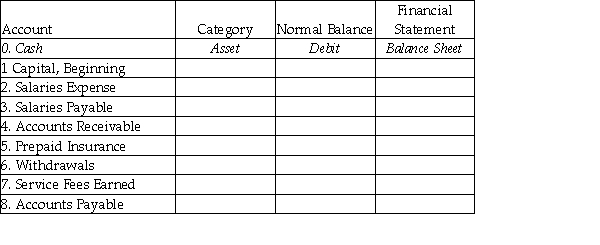

For each account listed, identify the category it belongs to, the normal balance (debit or credit), and the financial statement in which the account appears.

Definitions:

Foreign Tax Credit

A tax credit that cannot be refunded for income taxes paid to an external government due to withholdings from foreign income tax.

Foreign Income Taxes

Taxes paid to a foreign government for income earned outside of the taxpayer's resident country.

U.S. Tax Liability

The total amount of tax owed to the United States government, including federal, state, and local taxes.

Foreign Tax Credit

A tax credit that reduces the tax liability of an individual or entity for certain taxes paid to foreign governments.

Q6: To close the Withdrawals account:<br>A) debit Withdrawals;

Q27: The general journal entry to record the

Q35: The unified budget of the federal government

Q41: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7147/.jpg" alt=" " class="answers-bank-image d-block" rel="preload"

Q41: Which of the following is NOT a

Q45: Nonrestricted revenues of a not-for-profit health care

Q86: All closing entries must be posted after

Q108: Revenue and cash will always equal.

Q123: The Capital account debited and the Withdrawals

Q125: Debits must always exceed credits in a