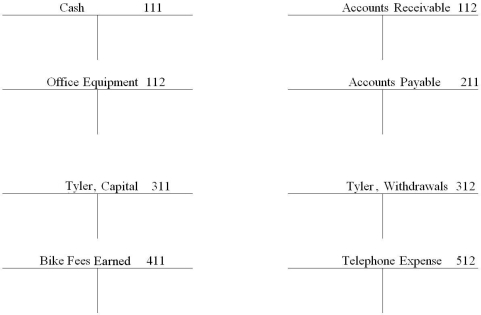

The following transactions occurred during June for Center City Cycle Shop. Record the transactions below in the T accounts. Place the letter of the transaction next to the entry. Foot and calculate the ending balances of the T accounts where appropriate.

a. invested $6500 in the bike service from his personal savings account.

b. Bought office equipment for cash, $900.

c. Performed bike service for a customer on account, $1,000.

d. Company cell phone bill received, but not paid, $80.

e. Collected $500 from customer in transaction c.

f. withdrew $300 for personal use.

Definitions:

Operating Cash Flow

The cash generated from normal operating activities of a business, reflecting its ability to generate sufficient cash to maintain operations.

Net Income

A company's overall income following the deduction of all expenditures and tax obligations from its total earnings.

Opportunity Costs

The loss of potential gain from other alternatives when one particular option is chosen over them.

Project Analysis

The process of evaluating the potential risks and returns associated with investing in a particular project.

Q10: FASB Statement No. 117 directs that revenues

Q12: The type of business organization that can

Q13: Financial statements that are prepared for a

Q16: If the Supplies account is NOT adjusted:<br>A)

Q18: The Government Performance and Results Act of

Q29: The State has a legally separate State

Q35: The adjusted trial balance on the worksheet

Q56: The FASAB requires that federal government agencies

Q111: When the trial balance includes a debit

Q116: The trial balance listing is in the