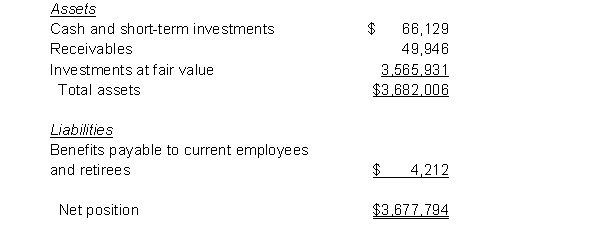

The statement of fiduciary net position for a school district's defined benefit pension plan shows the following (in condensed form and in thousands)

A.  The plan has been in operation for over 20 years and covers all school district employees. What is the most reasonable explanation of why the benefits payable to current employees and retirees is so small relative to plan assets?

The plan has been in operation for over 20 years and covers all school district employees. What is the most reasonable explanation of why the benefits payable to current employees and retirees is so small relative to plan assets?

B. Suppose that in the current year the school district's annual required contribution was $6,300,000. In the past, the district has always paid the annual required contribution in full. However, in the current year the district budgeted and paid into the pension trust fund only $5,000,000.

1. Prepare the journal entry that the district (not the plan) should make to record the year's pension contribution. You need not make budgetary or closing entries. The plan is accounted for in a governmental fund.

2. Prepare the journal entry to record the year's pension contribution for reporting in the district's government-wide statements.

C. The district's annual financial report indicated that its "normal cost" was $530,000 and that the "amortization of the unfunded actuarial accrued liability" was $100,000.

1. What is meant by "normal cost?"

2. What is meant by "unfunded actuarial accrued liability"? What are its principal causes? Why must it be amortized?

Definitions:

Externally Oriented

Focusing on the external environment and external stimuli rather than internal thoughts and feelings.

Botswana

A landlocked country located in Southern Africa, known for its diverse ecosystems and wildlife.

Black Male

A man of African descent or who identifies with the Black racial group.

Physically Abused

The infliction of physical injury by punching, beating, kicking, or other forms of physical harm.

Q19: Pocahontas School District, an independent public school

Q21: A major exception to the general rule

Q23: Governments invest in marketable securities for much

Q40: During the current year, St. Louise's Hospital

Q49: Not-for-profit organizations should report interest and dividends

Q54: Salt City issued $5 billion of bonds

Q73: GASB Statement No. 34 mandates that governments

Q73: Which of the following transactions would cause

Q95: The owner of a business paid the

Q112: When services are rendered but payment is