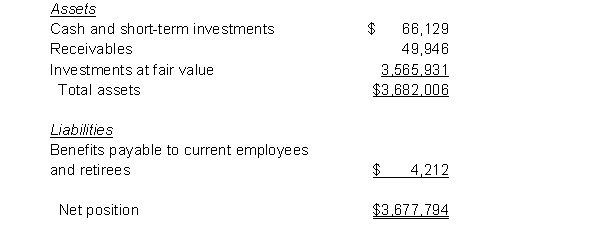

The statement of fiduciary net position for a school district's defined benefit pension plan shows the following (in condensed form and in thousands)

A.  The plan has been in operation for over 20 years and covers all school district employees. What is the most reasonable explanation of why the benefits payable to current employees and retirees is so small relative to plan assets?

The plan has been in operation for over 20 years and covers all school district employees. What is the most reasonable explanation of why the benefits payable to current employees and retirees is so small relative to plan assets?

B. Suppose that in the current year the school district's annual required contribution was $6,300,000. In the past, the district has always paid the annual required contribution in full. However, in the current year the district budgeted and paid into the pension trust fund only $5,000,000.

1. Prepare the journal entry that the district (not the plan) should make to record the year's pension contribution. You need not make budgetary or closing entries. The plan is accounted for in a governmental fund.

2. Prepare the journal entry to record the year's pension contribution for reporting in the district's government-wide statements.

C. The district's annual financial report indicated that its "normal cost" was $530,000 and that the "amortization of the unfunded actuarial accrued liability" was $100,000.

1. What is meant by "normal cost?"

2. What is meant by "unfunded actuarial accrued liability"? What are its principal causes? Why must it be amortized?

Definitions:

Cells Group

A collection of adjacent cells, typically in a spreadsheet, that are treated as a single entity for formatting or data manipulation purposes.

Zoom Slider

A graphical control element allowing users to change the magnification level of a document, image, or map.

Status Bar

A graphical control element at the bottom of a window that displays information about the current status of the application or document.

Office Clipboard

A feature within Microsoft Office applications that allows users to copy and store multiple items across Office programs.

Q1: FASAB standards preclude disclosure of investments in

Q9: The revenues of an internal service fund

Q37: The Midwest Circulatory Diseases Society placed an

Q37: Which of the following statements about accounting

Q41: Debt service funds are maintained to account

Q42: The construction of a bike path in

Q46: Assets reported in a government's investment trust

Q55: A public school district formally adopted a

Q70: The City of Twin Falls issued $5

Q72: Under the modified accrual basis of accounting