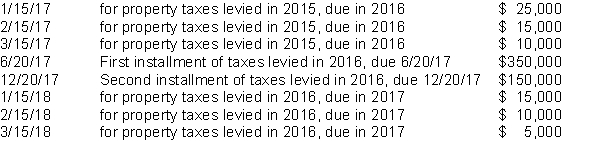

A city that has a 12/31 fiscal year end has adopted a policy of recognizing property tax revenue consistent with the 60-day rule allowable period under GAAP. Property taxes of $600,000 (of which none are estimated to be uncollectible) are levied in October 2016 to finance the activities of fiscal year 2017. Property taxes are due in two installments June 20 and December 20. Cash collections related to property taxes are as follows:  The total amount of property tax revenue that should be recognized in the governmental fund financial statements in 2017 is:

The total amount of property tax revenue that should be recognized in the governmental fund financial statements in 2017 is:

Definitions:

Q4: Cougar City issued $2 million in general

Q10: Governments are required to prepare a statement

Q13: Horizontal analysis is the study of percentage

Q21: Which of the following is not a

Q22: Sister City was notified by the state

Q28: Harbor City issued 6 percent tax-exempt bonds

Q32: Fund financial statements include which of the

Q54: Common-size statements _.<br>A) allow the users to

Q60: "Cash flows from investing activities" include which

Q67: As used in defining the modified accrual