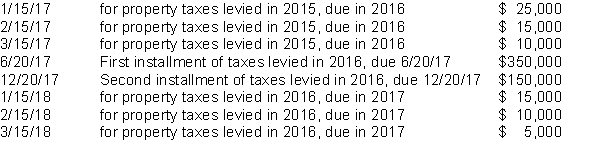

A city that has a 12/31 fiscal year end has adopted a policy of recognizing property tax revenue consistent with the 60-day rule allowable period under GAAP. Property taxes of $600,000 (of which none are estimated to be uncollectible) are levied in October 2016 to finance the activities of fiscal year 2017. Property taxes are due in two installments June 20 and December 20. Cash collections related to property taxes are as follows:  The total amount of property tax revenue that will be recognized in the government-wide financial statements in 2017 is:

The total amount of property tax revenue that will be recognized in the government-wide financial statements in 2017 is:

Definitions:

Executive Offices

Refers to the suite of rooms or building spaces used by the top executives of an organization, often including the CEO, COO, and other senior management.

Comparative Management

Studies how management practices differ between countries and cultures.

Outer-directed

Refers to individuals whose behaviors and decisions are influenced predominantly by external factors or the expectations of others rather than by personal values or desires.

Q6: A donor gives your city $100,000 to

Q15: When a fax machine purchased by a

Q19: Governments are not required to incorporate proprietary

Q27: In 1991, Katie City constructed a new

Q46: Dumas County has a December 31 fiscal

Q47: The amount of bonds payable that should

Q59: Financial assets reported by investment pools should

Q66: A state government has the following transactions

Q73: On July 1, Gilbert County bought computer

Q79: A comprehensive annual financial report (CAFR) includes