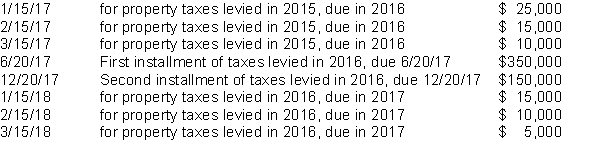

A city that has a 12/31 fiscal year end has adopted a policy of recognizing property tax revenue consistent with the 60-day rule allowable period under GAAP. Property taxes of $600,000 (of which none are estimated to be uncollectible) are levied in October 2016 to finance the activities of fiscal year 2017. Property taxes are due in two installments June 20 and December 20. Cash collections related to property taxes are as follows:  The total amount of property tax revenue that will be recognized in the government-wide financial statements in 2017 is:

The total amount of property tax revenue that will be recognized in the government-wide financial statements in 2017 is:

Definitions:

Resolution

The detail level of a digital image or display, defined by the number of pixels in width and height.

Handout Master

In presentation software like PowerPoint, it is the template used for controlling the layout and design of handout pages.

Background Styles

Predefined or custom settings that determine the appearance of the background in a document or presentation, including color, texture, or image.

Date & Time

Features in devices and software applications that display the current date and time, and often allow setting reminders or events.

Q22: Benchmarking is the comparison of a company's

Q24: Capital assets acquired are recorded as an

Q26: A review of Park City's books shows

Q26: Lenders use the financial statements of governments

Q27: In a highly controversial move, the mayor

Q39: Assume that the City of Juneau maintains

Q52: Which of the following are required basic

Q58: The inventory turnover ratio measures the average

Q77: Internal service funds should be consolidated with

Q83: The financial statements for Watertown Service Company