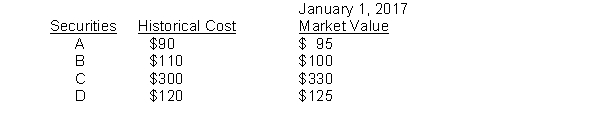

The City of Jolie maintains its books and records in a manner that facilitates the preparation of fund financial statements. Prepare all necessary journal entries to record the city's investment income and related transactions for the year 2017. The city has a 12/31 fiscal year-end. All of the City's investments are required to be reported at fair value. The beginning securities portfolio held by the general fund was as follows:  a.) Dividends received related to investments held in the general fund, $75.

a.) Dividends received related to investments held in the general fund, $75.

b.) On March 1, Security B is sold for $105.

c.) On April 1, Security E is purchased for $145

d.) On May 1 Security D is sold for $140.

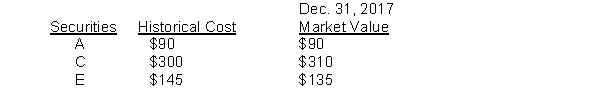

e.) On December 31, necessary adjusting entries are made to recognize appropriate amounts of gains/losses associated with the securities. The market values of the securities at year-end were as follows:

Definitions:

Commodities

Fundamental products utilized in trade that can be substituted with similar types of goods, commonly employed as components in manufacturing other products or services.

Perfect Market

An idealized market where all participants have equal access to information, there are no transaction costs, and buyers and sellers are too numerous to affect prices.

Utility Function

An economic model that represents a consumer's preference ranking over a set of goods or outcomes, used to analyze choice and behavior.

Double-Time

A term typically used in payroll to describe a rate of pay that is twice the employee's normal wage rate, often applied to overtime work.

Q3: A vertical analysis would be used if

Q25: The audit report in the annual report

Q26: "Cash flows from noncapital financing activities" include

Q30: General obligation debt is the obligation of

Q41: A city levies a 2 percent sales

Q56: Donald Corp. reported the following on its

Q61: The town of Terry began 2016 with

Q63: Previously Atomic City had issued bonds with

Q79: Data for Sherman, Inc. are as follows:

Q93: In preparing a statement of cash flows