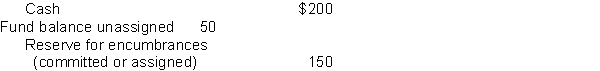

Assume that the County of Katerah maintains its books and records in a manner that facilitates preparation of the fund financial statements. The county formally integrates the budget into the accounting system and uses the encumbrance system. All appropriations lapse at year-end. At the beginning of the fiscal year, the county had the following balances in its accounts. All amounts are in thousands.

REQUIRED: Prepare the necessary entries for the current fiscal year.  (a) The county made the appropriate entry to restore the prior-year purchase commitments.

(a) The county made the appropriate entry to restore the prior-year purchase commitments.

(b) The county board approved a budget with revenues estimated to be $800 and expenditures of $750.

(c) The county received the items that had been ordered in the prior year at an actual cost of $135.

(d) The county ordered supplies at an estimated cost of $50 and equipment at an estimated cost of $70.

(e) The county incurred salaries and other operating expenses during the year totaling $600. The county paid these items in cash.

(f) The county received the equipment at an actual cost of $75.

(g) The county earned and collected, in cash, revenues of $810.

Definitions:

Authenticity Deficit

Describes a situation where there is a perceived lack of genuine or authentic qualities in a person, product, or brand.

Brand Storytelling

The technique of using compelling narratives to share the values, mission, and history of a brand, consequently building deeper connections with the audience.

Brand Purpose

The underlying mission or reason for a brand's existence beyond just making a profit, often related to making a positive impact on society or the environment.

Authenticity Deficit

The gap between how genuine or authentic a brand claims to be and how consumers actually perceive its authenticity.

Q5: In government-wide statements of activities are reported

Q19: Sue City has outstanding $5 million in

Q21: Which of the following is an objective

Q24: Days' sales in inventory measures how quickly

Q26: Under the GASB Statement No. 34 reporting

Q54: Common-size statements _.<br>A) allow the users to

Q55: Which of the following statements, regarding the

Q58: GASB requires that government entities present their

Q91: Cat Nap Corp. uses the indirect method

Q95: Extracts from the balance sheet of Michigan,