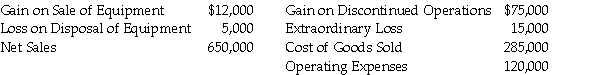

Mitchell Corporation's accounting records include the following items for the year ending December 31, 2017:  The income tax rate for the company is 45%. The company had 15,000 shares of common stock outstanding during 2017 and no preferred stock. Prepare Mitchell's income statement for the year ending December 31, 2017. Show how Mitchell reports EPS data on its 2017 income statement.

The income tax rate for the company is 45%. The company had 15,000 shares of common stock outstanding during 2017 and no preferred stock. Prepare Mitchell's income statement for the year ending December 31, 2017. Show how Mitchell reports EPS data on its 2017 income statement.

Definitions:

Nonselling Time

Periods in a salesperson's schedule not directly involved in selling activities, such as administrative tasks and travel.

Revenue Generated

The total amount of money produced from the sale of goods or services before any costs or expenses are subtracted.

Segment Accounts

The process of dividing a company's customer accounts into groups or segments based on shared characteristics to tailor marketing or sales efforts.

Value Analysis

An investigation that determines the best product for the money.

Q11: Which of the following funds is accounted

Q41: A company that reports a discontinued operation

Q48: The Single Audit Act of 1984 was

Q53: GAO standards specify that performance audit reports

Q62: Hector Production Company uses the indirect method

Q101: On January 1, 2016, Demarest Company purchased

Q102: Money earns income over time, a fact

Q106: Which of the following sections of the

Q120: Walker, Inc. uses the indirect method to

Q122: The cash paid for the purchase of