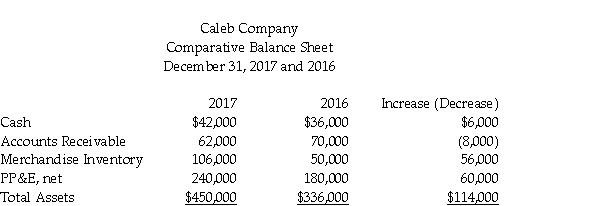

Caleb Auto Parts Company uses the indirect method to prepare its statement of cash flows. Refer to the following portion of the comparative balance sheet:  Additional information provided by the company includes the following:

Additional information provided by the company includes the following:

Equipment costing $104,000 was purchased for cash.

Equipment with a net book value of $20,000 was sold for $28,000.

Depreciation expense of $24,000 was recorded during the year.

Prepare the investing activities section of the statement of cash flows.

Definitions:

Tax

Mandatory financial charge imposed by a government on individuals, companies, or transactions to fund public expenditures.

Consumer Surplus

The difference between what consumers are willing to pay for a good or service and what they actually pay, indicating economic benefit.

Tax

Compulsory financial charges or other types of levies imposed upon a taxpayer by a governmental organization in order to fund government spending and various public expenditures.

Producer Surplus

The difference between what producers are willing to accept for a good or service and the higher price they actually receive, representing the benefit to producers.

Q2: Ocean Auto Parts Company uses the direct

Q25: Which of the following is the least

Q31: Secured bonds give bondholders the right to

Q35: A government's constituants rely on general purpose

Q36: An auditor is engaged to audit the

Q48: Tritan Company is preparing its statement of

Q72: On January 1, 2017, Streuly Sales issued

Q95: When a company receives a dividend payment

Q107: Barkin Corporation's accounting records include the following

Q111: Coleman, Inc. provides the following data from