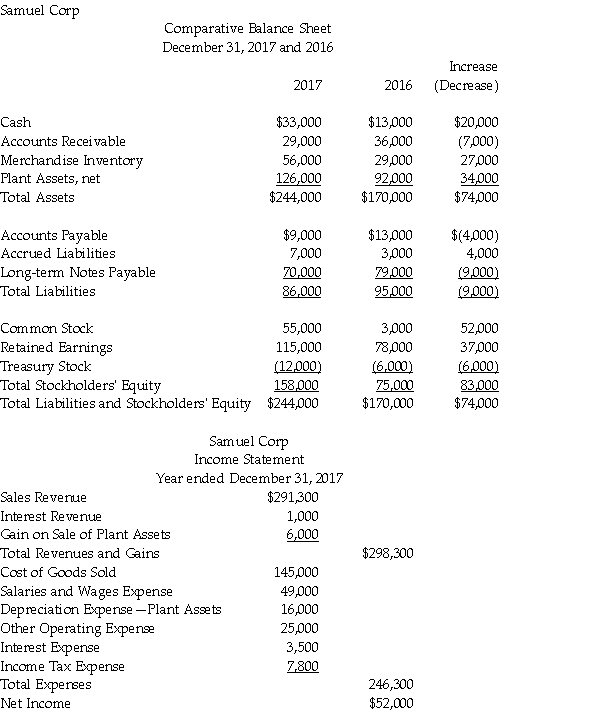

Samuel Corp. has provided the following information for the year ended December 31, 2017.  Additional information provided by the company includes the following:

Additional information provided by the company includes the following:

Equipment costing $60,000 was purchased for cash.

Equipment with a net book value of $10,000 was sold for $16,000.

Depreciation expense of $16,000 was recorded during the year.

During 2017, the company repaid $43,000 of long-term notes payable.

During 2017, the company borrowed $34,000 on a new long-term note payable.

There were no stock retirements during the year.

There were no sales of treasury stock during the year.

All sales are on credit.

Prepare the 2017 statement of cash flows, using the indirect method.

Definitions:

Average Variable Cost

The average cost of variable inputs (like labor and materials) per unit of output produced.

Minimum

The lowest point on a nonlinear curve, where the slope changes from negative to positive.

Economic Profit

The difference between the total revenue received by a business and the total implicit and explicit costs of a business.

ATC

Average Total Cost, which is the sum of all production costs divided by the quantity of output produced.

Q3: A mortgage payable is a long-term debt

Q14: On January 1, 2017, Walker Sales issued

Q17: Which of the following is an example

Q19: GAO independence guidelines permit CPA firms to

Q36: Use the balance sheet of Maine, Inc.

Q48: The debt ratio is the ratio of

Q67: Free cash flow is calculated by adding

Q93: In preparing a statement of cash flows

Q120: When a company receives interest revenue on

Q160: Generally accepted accounting principles require that interest