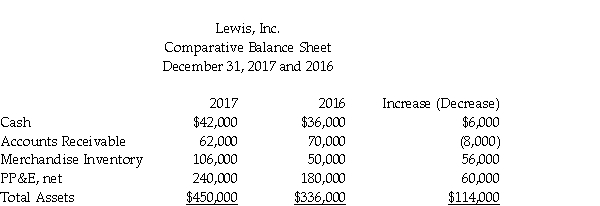

Lewis, Inc. uses the indirect method to prepare its statement of cash flows. Refer to the following portion of the comparative balance sheet:  Additional information provided by the company includes the following:

Additional information provided by the company includes the following:

Equipment costing $104,000 was purchased for cash.

Equipment with a net book value of $20,000 was sold for $28,000.

Depreciation Expense of $24,000 was recorded during the year.

Use the T-account format and evaluate the transactions affecting Property, Plant, and Equipment, net.

Definitions:

Limited Liability

A legal principle that limits an investor's losses to the amount of their investment, protecting personal assets beyond the investment in the company.

Corporate Profits

The residual income of businesses after paying all expenses, including taxes and operating costs, often reported quarterly or annually.

Corporate Directors

Members of a company's board of directors, elected by shareholders, responsible for overseeing the management and making key decisions affecting the company's direction.

Capital Budgeting

A process that companies use to evaluate and select long-term investments based on their potential to generate profit.

Q1: The net income of a company for

Q42: In which of the following activities is

Q45: Which of the following characteristics distinguishes a

Q51: When preparing the statement of cash flows

Q75: The only part that differs in a

Q89: Short-term investments _.<br>A) are debt and equity

Q93: Kelemen, Inc. provides the following information for

Q94: Retained earnings represents amounts received from stockholders

Q134: The financial statements for Lexington Service Company

Q145: Brink Moving Company reported the following amounts