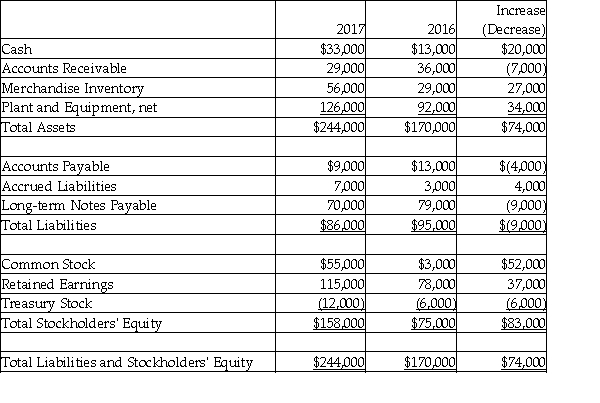

Skyler's Wine Company uses the direct method to prepare its statement of cash flows. Refer to the following financial statement information for the year ending December 31, 2017:

Skyler's Wine Company

Comparative Balance Sheet

December 31, 2017 and 2016  Skyler's Wine Company

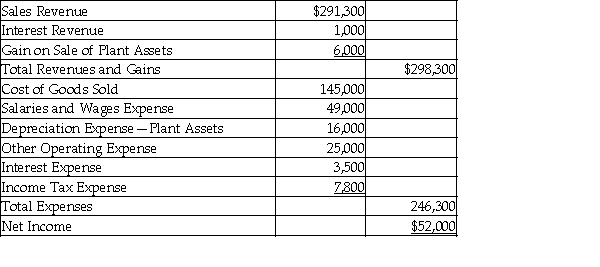

Skyler's Wine Company

Income Statement

Year Ended December 31, 2017  Additional information provided by the company includes the following:

Additional information provided by the company includes the following:

Equipment costing $60,000 was purchased for cash.

Equipment with a net asset value of $10,000 was sold for $16,000.

During 2017, the company repaid $43,000 of long-term notes payable.

During 2017, the company borrowed $34,000 on a new note payable.

There were no stock retirements during the year.

There were no sales of Treasury Stock during the year.

Prepare a complete statement of cash flows using the direct method.

Accrued Liabilities relate to other operating expenses.

Definitions:

Selling Price

The amount a buyer pays to purchase a product or service from a seller.

Variable Cost

A cost that varies with the level of output or production, such as materials and labor directly involved in manufacturing.

Fixed Costs

Expenses that do not change with the level of goods or services produced by a business, such as rent or a salaried employee's wages.

Variable Costs

Expenses that change in proportion to the activity or volume of production, sales, or services rendered.

Q28: Users of government financial statements should be

Q42: An audit of a government or not-for-profit

Q42: A city receives a donation from a

Q47: An amortization schedule details each loan payment's

Q90: Angelo Services, Inc. reported the following balance

Q99: Trading investments are categorized as noncurrent assets.

Q133: Both common and preferred stock carry the

Q154: When a bond is issued at a

Q157: If the debt ratio is too high,

Q201: The par value of stock is _.<br>A)