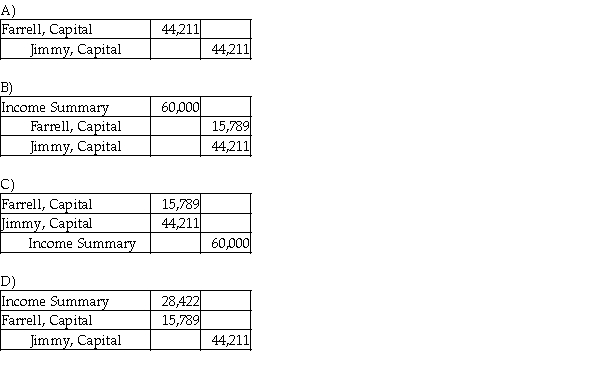

Farrell and Jimmy enter into a partnership agreement on May 1, 2017. Farrell contributes $50,000 and Jimmy contributes $140,000 as their capital contributions. They decide to share profits and losses in the ratio of their respective capital account balances. The net income for the year ended December 31, 2017 is $60,000. Which of the following is the correct journal entry to record the allocation of profit?

Definitions:

Leadership Role

A position or function in which an individual guides or influences a group towards accomplishing goals.

Stage

Refers to a specific phase or period in a process, development, or series of events.

Storming

The phase in team development where conflict and competition are at its peak, often following the initial forming stage.

Unnecessary Use

Utilization of resources, items, or services in situations where they are not needed, leading to waste or inefficiency.

Q23: On January 1, 2016, Belden, Inc. issued

Q30: The cost of land does not include

Q70: Gordon Corporation reported the following equity section

Q128: When using the effective-interest amortization method, the

Q128: Employer FICA tax is paid by the

Q146: The cost of an asset is $1,160,000,

Q152: Legal capital refers to the portion of

Q155: Alexander Corp. has the following balances as

Q160: Generally accepted accounting principles require that interest

Q164: A restaurant is being sued because a