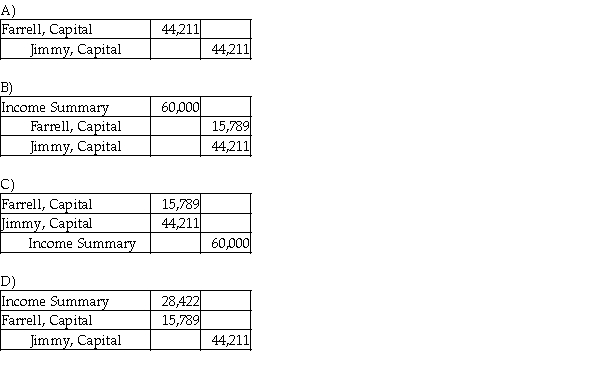

Farrell and Jimmy enter into a partnership agreement on May 1, 2017. Farrell contributes $50,000 and Jimmy contributes $140,000 as their capital contributions. They decide to share profits and losses in the ratio of their respective capital account balances. The net income for the year ended December 31, 2017 is $60,000. Which of the following is the correct journal entry to record the allocation of profit?

Definitions:

Customer Demands

The specific needs and desires of customers that influence their purchasing behavior and choices.

Q20: Which of the following is true of

Q69: Accounts receivable are also known as trade

Q86: On April 1, 2017, Planet Services received

Q104: Present value is the amount a person

Q130: Which of the following businesses is most

Q155: In which of the following ways does

Q159: Moretown, Inc. had the following transactions in

Q159: Keith and Jim are partners. Keith has

Q167: On December 1, 2017, Arthur, Inc. had

Q197: Which of the following is the correct