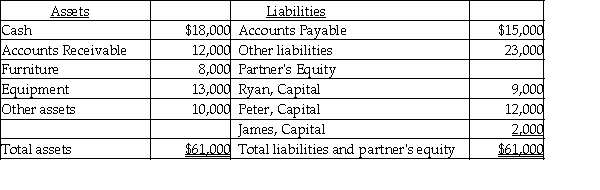

The balance sheet of Ryan, James and Peter firm as on December 31, 2017, is given below.  Ryan, Peter, and James share profits in the ratio 3:2:1. They have decided to liquidate the partnership with immediate effect. The furniture and the equipment were sold at a cumulative loss of $7,000. The accounts receivable were received in cash and the other assets were written off as worthless. The accounts payable and other liabilities were paid off at book value. James argued that he should receive a portion of the remaining cash, but Peter and Ryan argued otherwise. How much cash should James receive or pay?

Ryan, Peter, and James share profits in the ratio 3:2:1. They have decided to liquidate the partnership with immediate effect. The furniture and the equipment were sold at a cumulative loss of $7,000. The accounts receivable were received in cash and the other assets were written off as worthless. The accounts payable and other liabilities were paid off at book value. James argued that he should receive a portion of the remaining cash, but Peter and Ryan argued otherwise. How much cash should James receive or pay?

Definitions:

Popular TV Show

A television program that attracts a large audience and considerable viewership, often becoming a significant part of popular culture.

Clayton Act

Prohibits the practice of tie-in sales when they substantially lessen competition.

Tie-In Sales

A sales technique where the purchase of one product requires the purchase of another product as well.

Exclusive Agreements

Contracts that restrict parties from engaging in similar agreements with others, often used in distribution or partnership scenarios.

Q6: Federal unemployment compensation tax is paid by

Q18: The current period earnings column of the

Q20: The Allowance for Bad Debts is a

Q98: Farrell and Jimmy enter into a partnership

Q104: Which of the following would be included

Q117: The cost of an asset is $10,000,000,

Q130: Which of the following is a major

Q156: Which of the following statements regarding vacation

Q162: If a bond's stated interest rate is

Q166: Which of the following is true of