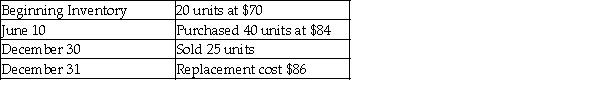

Jason Retail had the following balances and transactions during 2017.  The company maintains its records of inventory on a perpetual basis using the FIFO inventory costing method. Calculate the amount of ending Merchandise Inventory at December 31, 2017 using the lower-of-cost-or-market rule.

The company maintains its records of inventory on a perpetual basis using the FIFO inventory costing method. Calculate the amount of ending Merchandise Inventory at December 31, 2017 using the lower-of-cost-or-market rule.

Definitions:

Tax Evasion

The illegal act of not paying taxes owed, thereby hiding income or information from the tax authorities.

Partnership Interest

An ownership share held by a partner in a partnership, representing a portion of the partnership's assets and profits.

Statement of Dissociation

A formal document filed to announce a partner’s withdrawal from a partnership, which affects the partnership's legal and operational status.

Secretary of State

A high-ranking official in many governmental bodies who is typically in charge of foreign affairs or domestic records.

Q9: The periodic inventory records of Witte Veterinary

Q50: In a period of rising costs, the

Q71: The tracking of inventory shrinkage due to

Q86: Which of the following is an issue

Q92: For each account listed, identify the category

Q109: Which of the following entries would be

Q113: A cash equivalent is a highly liquid

Q142: The Public Company Accounting Oversight Board oversees

Q170: Which of the following describes a firewall?<br>A)

Q173: The loss of inventory that occurs because