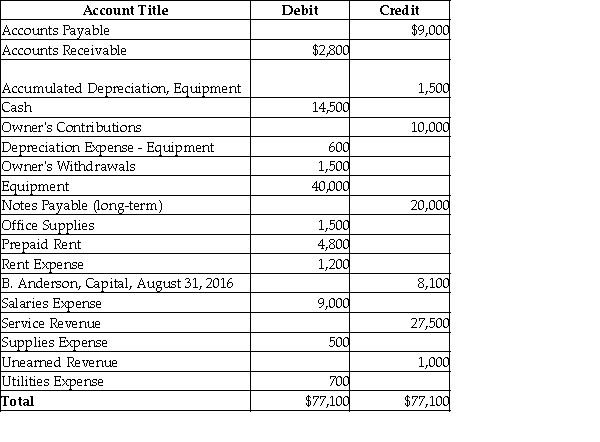

Use the Adjusted Trial Balance for Anderson Service Company to prepare the classified balance sheet at September 30, 2016. Use the report form. You must compute the ending balance of Owner's Equity.

Anderson Service Company

Adjusted Trial Balance

September 30, 2016

Balance

Definitions:

Depreciation

The process of allocating the cost of a tangible asset over its useful lifespan, representing wear and tear, deterioration, or obsolescence.

Section 1250

Section 1250 of the U.S. Internal Revenue Code deals with the tax treatment of gains from the sale of depreciable real property, distinguishing between ordinary income and capital gains.

Short-term Loss

A financial loss realized on the sale or exchange of an asset held for one year or less.

Accumulated Straight-line Depreciation

The total amount of depreciation expense that has been recorded for an asset to date, using the straight-line method of depreciation.

Q6: On the income statement, a merchandising company

Q19: Entries from the purchases journal are posted

Q78: When using the LIFO inventory costing method,

Q93: A balance sheet prepared in the report

Q130: A business purchases equipment for $8,000 cash.

Q133: A company purchased 80 units for $20

Q137: A payment of an expense in advance

Q145: "All debits are increases and all credits

Q149: The ability of a company to repay

Q151: Owner's Withdrawals is a(n) _ account that