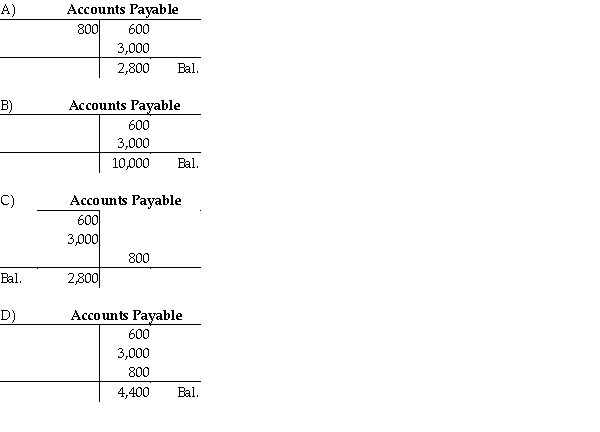

A business has the following transactions: * The business received $16,000 cash and issued common stock to stockholders.

* The business purchases $600 of office supplies on account.

* The business purchases $3,000 of furniture on account.

* The business renders services to various clients totaling $10,000 on account.

* The business pays out $1,500 for salaries expense and $3,500 for rent expense.

* The business pays $800 to supplier for the office supplies purchased earlier.

* The business collects $4,000 from one of its clients for services rendered earlier in the month.

At the end of the month, all journal entries are posted to the ledger. Accounts Payable will appear as which of the following?

Definitions:

Motivating Employees

The process of providing incentives, encouragement, and an environment that stimulates employees to achieve their best performance and engagement.

Inventory Turnover

A measure of how often a company's inventory is sold and replaced over a certain period, indicating efficiency in managing stock.

Discount Stores

General merchandise outlets that offer brand-name and private-label products at low prices.

Self-Service

A business model or technology that allows customers to perform services for themselves without the need for direct assistance from staff.

Q14: When translating foreign currency financial statements for

Q23: Which of the following funds frequently does

Q78: A business has the following transactions: *

Q88: Debit refers to the right side of

Q108: Melville Services has a weekly payroll of

Q114: The post-closing trial balance shows the net

Q114: Which of the following accounting elements does

Q134: The current ratio measures a company's _.<br>A)

Q159: For each user of accounting information, identify

Q167: Adjusting entries may involve any account, including