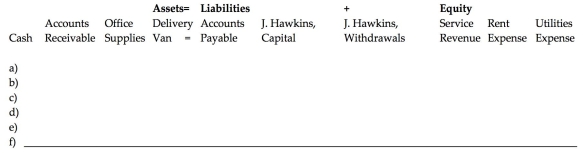

Analyze each of the following transactions in terms of their effects on the accounting equation of Hawkins Delivery Service. Enter the correct amounts in the columns of the spreadsheet.

a) The owner, James Hawkins contributes $75,000 to form the business.

b) The business purchases $750 of office supplies on account.

c) The business pays cash to purchase a delivery van for $25,000.

d) Services are performed for clients and $5,000 cash is received.

e) Cash is paid for office rent expense, $800 and utilities expense, $400.

f) The owner withdrew $1,000 from the company.

Definitions:

Trading Securities Portfolio

A collection of securities bought and held primarily for sale in the short term to generate income on short-term price differences.

Fair Value

The estimated price at which an asset can be bought or sold in an orderly transaction between market participants at the valuation date.

Unrealized Gain

An increase in the value of an asset that has not been sold, thus not yet generating actual profit.

Readily Marketable

Items or securities that are readily marketable can be quickly sold in the market without significantly affecting their price.

Q1: For accounting purposes, depreciation refers to the

Q2: Gains from remeasuring a foreign subsidiary's financial

Q3: The liability for general obligation long-term debt

Q21: Creditors are classified by law as either

Q26: Pink desires to purchase a one-fourth capital

Q28: Due to the fact that the partnership

Q38: For a university, the receipt of assets

Q74: Which of the following statements is true

Q83: Which of the following statements is true

Q151: Owner's Withdrawals is a(n) _ account that