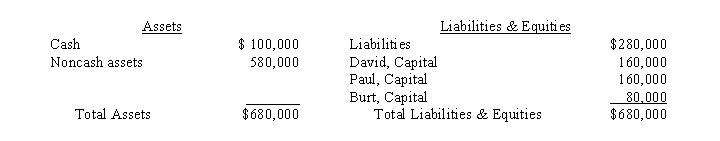

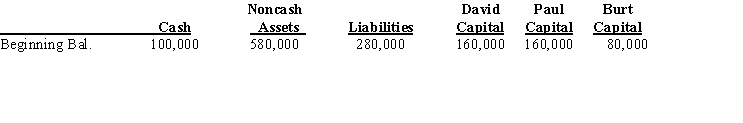

David, Paul, and Burt are partners in a CPA firm sharing profits and losses in a ratio of 2:2:3, respectively. Immediately prior to liquidation, the following balance sheet was prepared:  Required:

Required:

Assuming the noncash assets are sold for $300,000, determine the amount of cash to be distributed to each partner. Complete the worksheet and clearly indicate the amount of cash to be distributed to each partner in the spaces provided. No cash is available from any of the three partners.

Definitions:

Legal Relationship

A connection between entities or individuals that is recognized and enforceable by law.

Radio

A radio is a technology that uses radio waves to transmit information, such as sound, by systematically modulating properties of electromagnetic energy waves transmitted through space.

Contract Formation

The process of creating a legally binding agreement, typically involving offer, acceptance, consideration, and mutual consent among parties.

Self-Service Merchandising

A retail strategy where customers select products by themselves without direct assistance from staff, typically in grocery or department stores.

Q3: The GASB has the responsibility for establishing

Q3: Price Company acquired 75 percent of the

Q14: The following information regarding the fiscal year

Q18: Petunia Company acquired an 80% interest in

Q19: The partnership of Larry, Moe, and Curly

Q29: Gain or loss resulting from an intercompany

Q33: Revenues and expenses of hospitals are recorded

Q34: Which of the following financial statements would

Q62: Which of the following is a liability

Q154: The balance of owner's equity at the