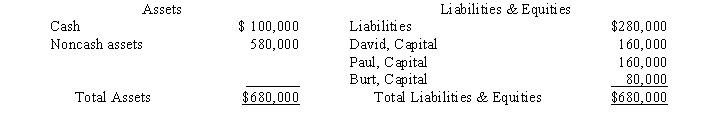

David, Paul, and Burt are partners in a CPA firm sharing profits and losses in a ratio of 2:2:3, respectively. Immediately prior to liquidation, the following balance sheet was prepared:  Required:

Required:

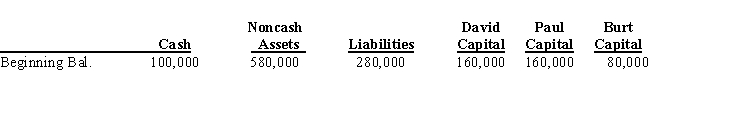

Assuming the noncash assets are sold for $160,000, determine the amount of cash to be distributed to each partner assuming all partners are personally solvent. Complete the worksheet and clearly indicate the amount of cash to be distributed to each partner in the spaces provided.

Definitions:

Consumer Surplus

The differentiation between the total investment consumers are willing and able to make in a product or service and the investment they end up making.

Marginal Utility

The supplementary joy or advantage an individual experiences when acquiring an extra unit of a good or service.

Total Utility

The total satisfaction or benefit that a consumer derives from consuming a certain quantity of a good or service.

Total Utility

The total satisfaction received from consuming a particular quantity of goods and services.

Q4: Petunia Corporation owns 100% of Stone Company's

Q6: On January 1, 2012, Parent Company purchased

Q6: GASB Statement No. 34 specifies how governments

Q7: Greco, Inc. a U.S. corporation, bought machine

Q7: Blink Company, which uses the FIFO inventory

Q21: The summarized balances of the accounts of

Q29: The following data are taken from the

Q37: P Corporation paid $420,000 for 70% of

Q40: The accounting process of transferring a transaction

Q179: A publicly traded company in the United