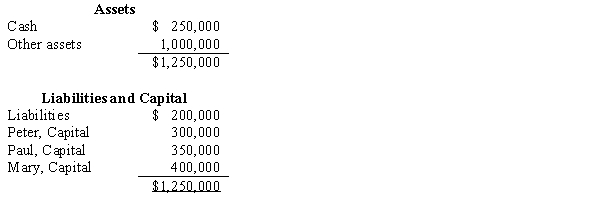

The partnership of Peter, Paul, and Mary share profits and losses in the ratio of 4:4:2, respectively. The partners voted to dissolve the partnership when its assets, liabilities, and capital were as follows:  The partnership will be liquidated over a prolonged period of time. As cash is available, it will be distributed to the partners. The first sale of noncash assets having a book value of $600,000 realized $475,000. How much cash should be distributed to each partner after this sale?

The partnership will be liquidated over a prolonged period of time. As cash is available, it will be distributed to the partners. The first sale of noncash assets having a book value of $600,000 realized $475,000. How much cash should be distributed to each partner after this sale?

Definitions:

Amplitude

The maximum extent of a vibration or oscillation, measured from the position of equilibrium.

Hertz

In the International System of Units (SI), the measure of frequency that is equivalent to one cycle every second.

Genetic Predisposition

An inherited genetic pattern that increases the likelihood of developing certain traits, conditions, or diseases.

Nutritive Substances

Compounds that provide nourishment essential for the growth and maintenance of life, typically including proteins, carbohydrates, fats, vitamins, and minerals.

Q20: On January 1, 2012, Pharma Company purchased

Q21: In accounting for research and development costs.<br>A)

Q24: In a business combination, which of the

Q28: Under Southdale Hospital's established rate structure, the

Q30: There are a number of business situations

Q63: Which one of the following account groups

Q112: Liabilities represent creditors' claims on the business's

Q129: Wentlent Services Company records deferred expenses as

Q134: A transaction is any event that affects

Q177: Melody Instruments Company sells musical instruments. On