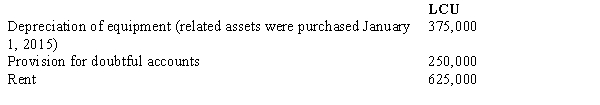

A wholly owned subsidiary of a U.S. parent company has certain expense accounts for the year ended December 31, 2017, stated in local currency units (LCU) as follows:  The exchange rates at various dates are as follows:

The exchange rates at various dates are as follows:  Assume that the LCU is the subsidiary's functional currency and that the charges to the expense accounts occurred approximately evenly during the year. What total dollar amount should be included in the translated income statement to reflect these expenses?

Assume that the LCU is the subsidiary's functional currency and that the charges to the expense accounts occurred approximately evenly during the year. What total dollar amount should be included in the translated income statement to reflect these expenses?

Definitions:

Banded Columns

Alternating column colors in a table or spreadsheet to improve readability.

DLOOKUP Function

A database function in Microsoft Access that searches for a value in a table or query and returns the corresponding value from another field in the same record.

TRANSPOSE

A function in spreadsheets that converts rows to columns and vice versa, reorienting data in a table.

Months

Units of time, typically used in calendars, that approximate the natural period related to the motion of the Moon; typically consisting of 30 or 31 days, except February.

Q4: Which of the following statements is true

Q6: When the donor has specified a particular

Q6: P Corporation acquired a 60% interest in

Q17: On January 1, 2017, Pantera Company purchased

Q22: P Company bought 60% of the common

Q70: The opportunity cost of a purchase is<br>A)

Q95: A corporation pays income taxes on its

Q97: Which of the following financial statements shows

Q104: A business collects cash from a customer

Q114: Which of the following financial statements reports