Consider the following information:

1. On November 1, 2017, a U.S. firm contracts to sell equipment (with an asking price of 500,000 pesos) in Mexico. The firm will take delivery and will pay for the equipment on February 1, 2018.

2. On November 1, 2017, the company enters into a forward contract to sell 500,000 pesos for $0.0948 on February 1, 2018.

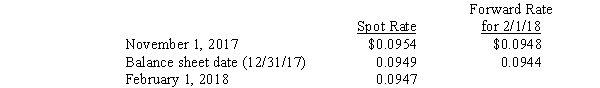

3. Spot rates and the forward rates for February 1, 2018, settlement were as follows (dollars per peso):  4. On February 1, the equipment was sold for 500,000 pesos. The cost of the equipment was $20,000.

4. On February 1, the equipment was sold for 500,000 pesos. The cost of the equipment was $20,000.

Required:

Prepare all journal entries needed on November 1, December 31, and February 1 to account for the forward contract, the firm commitment, and the transaction to sell the equipment.

Definitions:

Disposable Income

Discretionary income for households to utilize in their saving and spending after the enforcement of income taxes.

Consumption

Refers to the use of goods and services by households or individuals for personal needs or for leisure, as opposed to investment or savings.

Billion

A numerical value represented by 1,000 million or 10^9.

Induced Consumption

Consumer spending that varies with income, representing the portion of income that households spend on goods and services rather than saving.

Q15: Consolidated net income for a parent company

Q23: Tangent Corporation was forced into bankruptcy and

Q25: Which of the following is a limitation

Q27: The noncontrolling interest's share of the selling

Q28: Which of the following is NOT a

Q31: Revenues of a special revenue fund of

Q34: In a partnership liquidation the final cash

Q36: The Difference between Implied and Book Value

Q97: Which of the following financial statements shows

Q143: The most that the owner of a