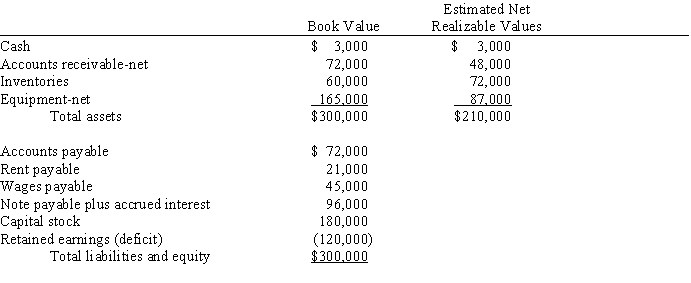

Down Dog Corporation filed a petition under Chapter 7 of the U.S. Bankruptcy Act on June 30, 2017. Data relevant to its financial position as of this date are:  Required:

Required:

A. Prepare a statement of affairs assuming that the note payable and interest are secured by a mortgage on the equipment and that wages are less than $4,650 per employee.

B. Estimate the amount that will be paid to each class of claims if priority liquidation expenses including trustee fees are $24,000 and estimated net realizable values are actually realized.

Definitions:

Quarterly Meeting

A scheduled meeting that occurs four times a year, typically to review quarterly performance and plan for future strategies.

Shareholders

Individuals or entities that own shares in a corporation and have potential financial gains or losses based on the company's performance.

Terminated Corporation

A terminated corporation is a company that has gone through the legal process of dissolution and has ceased its operations and its corporate existence.

Liability

A legal responsibility or obligation, often involving financial restitution in the event of causing loss or damage.

Q2: In the preparation of a consolidated statement

Q3: On January 1, 2017, Prince Company purchased

Q10: On January 1 2016, Pounder Company purchased

Q21: Kettle Company purchased equipment for 375,000 British

Q25: If an impairment loss is recorded on

Q25: If a portion of an investment is

Q26: During the years ending June 30, 2016,

Q66: At any quantity, when the marginal benefit

Q158: Which of the following is NOT a

Q164: A creditor who has loaned money to