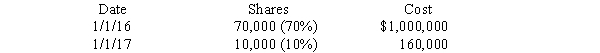

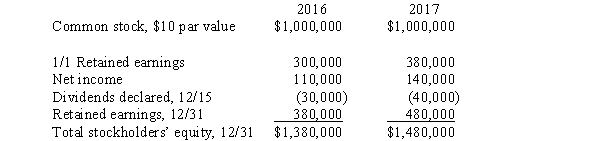

Poole made the following purchases of Smarte Company common stock:  Stockholders' equity information for Smarte Company for 2016 and 2017 follows:

Stockholders' equity information for Smarte Company for 2016 and 2017 follows:  On July 1, 2017, Poole sold 14,000 shares of Smarte Company common stock on the open market for $22 per share. The shares sold were purchased on January 1, 2016. Smarte notified Poole that its net income for the first six months was $70,000. Any difference between cost and book value relates to subsidiary land. Poole uses the cost method to account for its investment in Smarte Company.

On July 1, 2017, Poole sold 14,000 shares of Smarte Company common stock on the open market for $22 per share. The shares sold were purchased on January 1, 2016. Smarte notified Poole that its net income for the first six months was $70,000. Any difference between cost and book value relates to subsidiary land. Poole uses the cost method to account for its investment in Smarte Company.

Required:

A. Prepare the journal entry made by Poole to record the sale of the 14,000 shares on July 1, 2017.

B. Prepare the workpaper eliminating entries needed for a consolidated statements workpaper on December 31, 2017.

C. Compute the amount of noncontrolling interest that would be reported on the consolidated balance sheet on December 31, 2017.

Definitions:

Self-Interests

The personal gain or benefit that an individual seeks in making decisions or taking actions, often considered in contrast to the common good.

Graen

Refers to George B. Graen, a researcher known for his work on Leader-Member Exchange (LMX) theory, which focuses on the relationship between leaders and subordinates.

Uhl-Bien

A researcher known for contributions in leadership studies, focusing on relational leadership and complex organizing processes.

Leadership Making

A process of developing leadership qualities within individuals or organizations to foster effective leadership roles.

Q13: Under the acquisition method, if the fair

Q15: A good reason for NNOs to adopt

Q17: Prepare in general journal form the workpaper

Q20: Company S sells equipment to its parent

Q25: On January 1, 2016, BelgianAir purchases an

Q27: The noncontrolling interest's share of the selling

Q28: The view that the noncontrolling interest in

Q110: It is crucial to recognize that_ and

Q142: The concept of _explains that making one

Q174: Indirect incentives create_ consequences.<br>A) positive<br>B) negative<br>C) indirect<br>D)