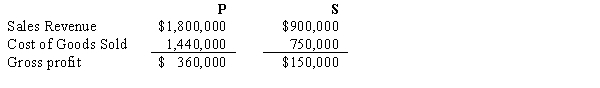

P Company regularly sells merchandise to its 80%-owned subsidiary, S Corporation. In 2016, P sold merchandise that cost $192,000 to S for $240,000. Half of this merchandise remained in S's December 31, 2016 inventory. During 2017, P sold merchandise that cost $300,000 to S for $375,000. Forty percent of this merchandise inventory remained in S's December 31, 2017 inventory. Selected income statement information for the two affiliates for the year 2017 is as follows:  Consolidated sales revenue for P and Subsidiary for 2017 are:

Consolidated sales revenue for P and Subsidiary for 2017 are:

Definitions:

Cost of Capital

The return rate that a firm needs to achieve to cover the cost of generating funds in the marketplace, essentially what it must pay in order to use capital.

Living Standards

The level of wealth, comfort, material goods, and necessities available to a certain socioeconomic class or geographic area.

GDP Growth

An increase in a country's gross domestic product over time, indicating economic expansion.

Cost of Capital

The cost of funds used for financing a business, often considered as the required rate of return to make a capital budgeting project, such as building a new factory, worthwhile.

Q16: Decision makers engage in marginal thinking by<br>A)

Q17: The ABC partnership has the following capital

Q23: Which of the following funds frequently does

Q25: Pratt Company, who owns an 80% interest

Q29: Pell Company purchased 90% of the stock

Q31: The primary beneficiary of a variable interest

Q33: Financial statements are prepared after an entity's

Q39: The bonus and goodwill methods of recording

Q131: Someone has a comparative advantage in producing

Q137: If the United States creates a trade