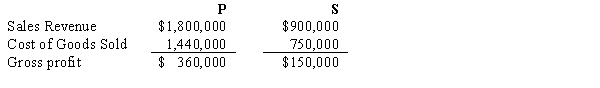

P Company regularly sells merchandise to its 80%-owned subsidiary, S Corporation. In 2016, P sold merchandise that cost $192,000 to S for $240,000. Half of this merchandise remained in S's December 31, 2016 inventory. During 2017, P sold merchandise that cost $300,000 to S for $375,000. Forty percent of this merchandise inventory remained in S's December 31, 2017 inventory. Selected income statement information for the two affiliates for the year 2017 is as follows:  Consolidated cost of goods sold for P Company and Subsidiary for 2017 are:

Consolidated cost of goods sold for P Company and Subsidiary for 2017 are:

Definitions:

AASB 132

Refers to the Australian Accounting Standards Board standard on Financial Instruments: Presentation, which covers the presentation of financial instruments in financial statements.

Financial Liability

Any liability that is a contractual obligation to deliver cash or another financial asset to another entity, or to exchange financial assets or financial liabilities with another entity under conditions that are potentially unfavourable to the entity; or a contract that may be settled in the entity’s own equity instruments and is a non-derivative for which the entity may be obliged to deliver a variable number of the entity’s own equity instruments, or a derivative that may be settled other than by the exchange of a fixed amount of cash or another financial asset for a fixed number of the entity’s own equity instruments. For this purpose, rights, options, or warrants to acquire a fixed number of the entity’s own equity instruments for a fixed amount of any currency are equity instruments if the entity offers the rights, options, or warrants pro rata to all of its existing owners of the same class of its own non-derivative equity instruments.

Contractual Right

A legally enforceable claim that arises out of a contract, allowing the holder to demand performance or compensation.

AASB 132

The Australian Accounting Standards Board standard relating to financial instruments, covering the presentation, classification, and disclosures of financial instruments.

Q3: Under which set of circumstances would it

Q9: A transaction gain is recorded when there

Q13: On January 1 2016, Paulus Company purchased

Q15: The exchange rate quoted for future delivery

Q19: During 2017, a U.S. company purchased inventory

Q20: Edina Company acquired the assets (except cash)

Q31: A business combination is accounted for properly

Q80: Trade-offs occur in all of the following

Q84: What is the indirect incentive in the

Q143: Which statement best describes the opportunity cost