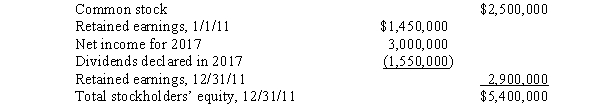

The following balances were taken from the records of S Company:  P Company owns 80% of the common stock of S Company. During 2017, P Company purchased merchandise from S Company for $4,000,000. S Company sells merchandise to P Company at cost plus 25% of cost. On December 31, 2017, merchandise purchased from S Company for $1,250,000 remains in the inventory of P Company. On January 1, 2017, P Company's inventory contained merchandise purchased from S Company for $525,000. The affiliated companies file a consolidated income tax return. There was no difference between the implied value and the book value of net assets acquired.

P Company owns 80% of the common stock of S Company. During 2017, P Company purchased merchandise from S Company for $4,000,000. S Company sells merchandise to P Company at cost plus 25% of cost. On December 31, 2017, merchandise purchased from S Company for $1,250,000 remains in the inventory of P Company. On January 1, 2017, P Company's inventory contained merchandise purchased from S Company for $525,000. The affiliated companies file a consolidated income tax return. There was no difference between the implied value and the book value of net assets acquired.

Required:

A. Prepare all workpaper entries necessitated by the intercompany sales of merchandise.

B. Compute noncontrolling interest in consolidated income for 2017.

C. Compute noncontrolling interest in consolidated net assets on December 31, 2017.

Definitions:

Gravity Device

A tool or apparatus designed to utilize the force of gravity for various purposes, often medical or scientific.

DF10 Administration Set

A medical device used for the administration of fluids and medications via infusion, designed with a specific flow rate.

LRS

Lactated Ringer's Solution, an isotonic fluid commonly used for intravenous hydration and electrolyte balancing.

Intermittent

Occurring at irregular intervals; not continuous or steady.

Q17: In the absence of an agreement among

Q20: An advance cash distribution plan specifies the

Q22: Which of the following would be restated

Q27: On January 1, 2016, Poole Company purchased

Q28: In accounting for liabilities, IFRS interprets "probable"

Q30: A city should record depreciation as an

Q30: In the area of many college campuses,

Q32: Coastal regions have stronger commercial fishing economies

Q37: What is Monica's opportunity cost of baking

Q105: A mother takes her daughter on an