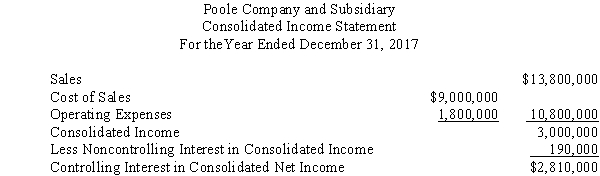

Poole Company owns a 90% interest in Solumbra Company. The consolidated income statement drafted by the controller of Poole Company appeared as follows:  During your audit you discover that intercompany sales transactions were not reflected in the controller's draft of the consolidated income statement. Information relating to intercompany sales and unrealized intercompany profit is as follows:

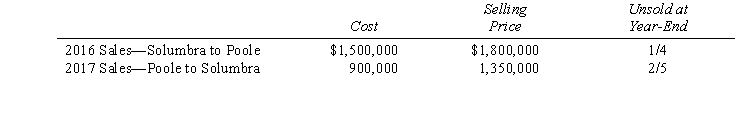

During your audit you discover that intercompany sales transactions were not reflected in the controller's draft of the consolidated income statement. Information relating to intercompany sales and unrealized intercompany profit is as follows:  Required:

Required:

Prepare a corrected consolidated income statement for Poole Company and Solumbra Company for the year ended December 31, 2017.

Definitions:

Unaided Recall

A measure of how well a brand or product is remembered by consumers without any prompts or cues.

Staircase Analysis

An approach to incremental planning or problem-solving that envisions steps or stages, much like climbing a staircase, to reach a desired outcome.

Aided Recall

A measure of brand awareness where consumers recognize a brand when provided with some prompt, contrasting with unaided recall where no prompt is provided.

Unattractive

Lacking appeal or not enticing; often used in marketing to describe products or markets with low potential for sales.

Q10: Paid-in capital accounts are translated using the

Q11: The view that consolidated financial statements represent

Q12: Failure to eliminate intercompany sales would result

Q24: Which of the following is NOT a

Q28: P Corporation acquired an 80% interest in

Q31: The difference between normal earnings and expected

Q34: The following transactions take place:<br>1. On January

Q124: Which scenario describes studying for an economics

Q134: Macroeconomics would be concerned with<br>A) a family's

Q162: Laura leaves her job as an accountant,