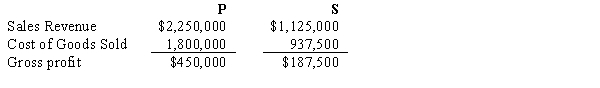

P Company regularly sells merchandise to its 80%-owned subsidiary, S Corporation. In 2016, P sold merchandise that cost $240,000 to S for $300,000. Half of this merchandise remained in S's December 31, 2016 inventory. During 2017, P sold merchandise that cost $375,000 to S for $468,000. Forty percent of this merchandise inventory remained in S's December 31, 2017 inventory. Selected income statement information for the two affiliates for the year 2017 is as follows:  Consolidated sales revenue for P and Subsidiary for 2017 are:

Consolidated sales revenue for P and Subsidiary for 2017 are:

Definitions:

Market Rate

The prevailing price or interest rate available in the marketplace for goods, services, or securities.

Oil Reserve

An estimate of the amount of crude oil located in a particular economic region with the potential of being extracted and exploited.

Profit Per Barrel

The amount of financial gain realized from the sale of one barrel of a commodity, often used in the context of oil production.

Extract

To remove or take out, especially by effort or force.

Q10: All NNOs have current restricted funds and

Q11: The basic financial statements for all NNOs

Q18: Advertising costs may be accrued or deferred

Q22: Which of the following would be restated

Q23: Goodwill represents the excess of the implied

Q24: The purchase by a subsidiary of some

Q26: Customers' meter deposits which cannot be spent

Q74: The cost of a trade-off is known

Q86: How will a reduction in the national

Q149: The balance sheet of a business summarizes