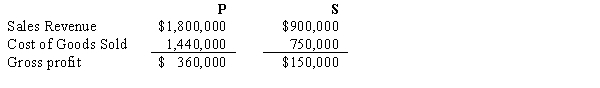

P Company regularly sells merchandise to its 80%-owned subsidiary, S Corporation. In 2016, P sold merchandise that cost $192,000 to S for $240,000. Half of this merchandise remained in S's December 31, 2016 inventory. During 2017, P sold merchandise that cost $300,000 to S for $375,000. Forty percent of this merchandise inventory remained in S's December 31, 2017 inventory. Selected income statement information for the two affiliates for the year 2017 is as follows:  Consolidated sales revenue for P and Subsidiary for 2017 are:

Consolidated sales revenue for P and Subsidiary for 2017 are:

Definitions:

Contribution Margin

The amount of revenue remaining after deducting variable costs, which can be used to cover fixed costs and contribute to profit.

Fixed Costs

Costs that do not change with the level of production output, such as rent, salaries, and insurance.

Variable Selling

Costs that change in proportion to the volume of goods or services sold.

Administrative Expense

Costs related to the general operation of a company that are not directly tied to a specific department or product, like salaries of executive officers and support staff.

Q6: Pendleton Company acquired a 70% interest in

Q8: Pentagon Company acquired 90% of Smoker Company's

Q13: An advance cash distribution plan is prepared:<br>A)

Q17: When there have been intercompany sales of

Q18: If Kingsley can sell paper at a

Q18: SFAS No. 142 requires that goodwill impairment

Q30: Which of the following is an advantage

Q33: An economist would argue that the true

Q33: Publicly owned companies are usually required to

Q113: The scientific method and the tools of