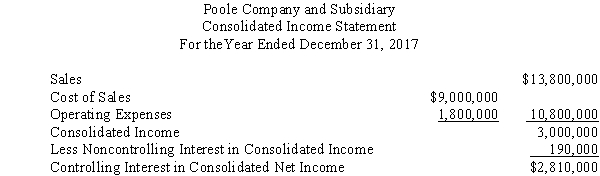

Poole Company owns a 90% interest in Solumbra Company. The consolidated income statement drafted by the controller of Poole Company appeared as follows:  During your audit you discover that intercompany sales transactions were not reflected in the controller's draft of the consolidated income statement. Information relating to intercompany sales and unrealized intercompany profit is as follows:

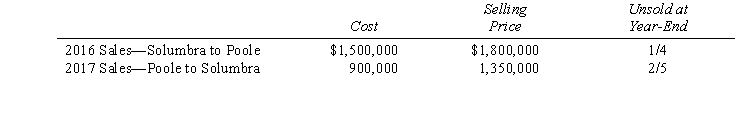

During your audit you discover that intercompany sales transactions were not reflected in the controller's draft of the consolidated income statement. Information relating to intercompany sales and unrealized intercompany profit is as follows:  Required:

Required:

Prepare a corrected consolidated income statement for Poole Company and Solumbra Company for the year ended December 31, 2017.

Definitions:

Votes By Shareholders

The action of shareholders exercising their rights to vote on corporate matters, such as electing directors or approving mergers.

Stock Options

Financial incentives offered to employees, providing them the right to purchase company stock at a set price for a specific time period.

Piecework Rates

A compensation system where employees are paid a fixed rate for each unit produced or action performed, rather than receiving an hourly wage.

Standardized Jobs

Positions characterized by uniform tasks, requirements, and qualifications across different settings or organizations.

Q1: The partnership of Gilligan, Skipper, and Ginger

Q2: Pizza Company purchased Salt Company common stock

Q15: The expendable fund entity's measurement focus is

Q19: All of the following are true regarding

Q28: The basic goal of economics is to<br>A)

Q36: The Difference between Implied and Book Value

Q55: An economist is most capable of determining<br>A)

Q56: Which of the following financial statements is

Q95: If opportunity cost is the value of

Q145: Nadine is considering the "dress well, test