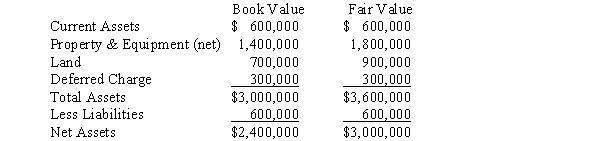

Plain Corporation acquired a 75% interest in Swampy Company on January 1, 2016, for $2,000,000. The book value and fair value of the assets and liabilities of Swampy Company on that date were as follows:  The property and equipment had a remaining life of 6 years on January 1, 2016, and the deferred charge was being amortized over a period of 5 years from that date. Common stock was $1,500,000 and retained earnings was $900,000 on January 1, 2016. Plain Company records its investment in Swampy Company using the cost method.

The property and equipment had a remaining life of 6 years on January 1, 2016, and the deferred charge was being amortized over a period of 5 years from that date. Common stock was $1,500,000 and retained earnings was $900,000 on January 1, 2016. Plain Company records its investment in Swampy Company using the cost method.

Required:

Prepare, in general journal form, the December 31, 2016, workpaper entries necessary to:

A. Eliminate the investment account.

B. Allocate and amortize the difference between implied and book value.

Definitions:

Depreciation Method

A systematic approach used to allocate the cost of a tangible asset over its useful life.

Sales Price

The amount of money charged for a product or service, or the sum that customers are willing to pay for it.

Straight-line Method

A depreciation technique that allocates an equal amount of depreciation expense each year over the useful life of an asset.

Estimated Salvage Value

The expected value that an asset will realize upon its sale at the end of its useful life, used in computing depreciation.

Q9: Under the partial equity method, the entry

Q9: P Corporation acquired an 80% interest in

Q12: On November 1, 2017, American Company sold

Q14: What is the underlying reason a governmental

Q14: P Corporation issued 10,000 shares of common

Q35: One reason a parent company may pay

Q48: An example of a direct positive incentive

Q144: Which of the following is a normative

Q154: The United States is able to experience

Q161: William can create 30 meals in one