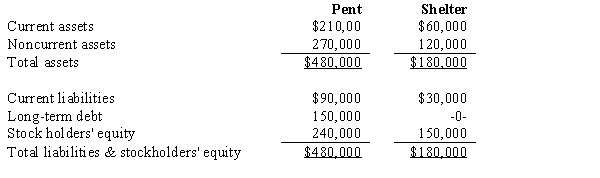

On January 1, 2016, Pent Company and Shelter Company had condensed balance sheets as follows:  On January 2, 2016 Pent borrowed $180,000 and used the proceeds to purchase 90% of the outstanding common stock of Shelter. This debt is payable in 10 equal annual principal payments, plus interest, starting December 30, 2016. Any difference between book value and the value implied by the purchase price relates to land. On Pent's January 2, 2016 consolidated balance sheet, noncurrent assets should be:

On January 2, 2016 Pent borrowed $180,000 and used the proceeds to purchase 90% of the outstanding common stock of Shelter. This debt is payable in 10 equal annual principal payments, plus interest, starting December 30, 2016. Any difference between book value and the value implied by the purchase price relates to land. On Pent's January 2, 2016 consolidated balance sheet, noncurrent assets should be:

Definitions:

Qualified Plan

A retirement plan that meets the requirements of the Internal Revenue Code and ERISA, offering tax benefits to both employers and employees.

Tax Deductions

Expenses that can be subtracted from gross income to reduce the total amount of income tax owed.

Retirement Benefits

Financial support or services provided to employees after they exit the workforce, including pensions, health insurance, and other perks.

Independent Contractors

Individuals or entities contracted to perform work for another entity as non-employees, responsible for their own taxes and benefits.

Q12: On January 1, 2017, Pioneer Company purchased

Q15: An entity is permitted to aggregate operating

Q24: Bruges Electronics Inc. offers one model of

Q24: On April 1, 2017, Manatee Company entered

Q26: Which of the following situations best describes

Q52: Alejandro and Roger are working on a

Q54: The proliferation of BitTorrent and other file

Q101: The important act of holding all other

Q134: The production possibilities frontier PPF) shows<br>A) the

Q144: If Alexander doesn't like changing the oil