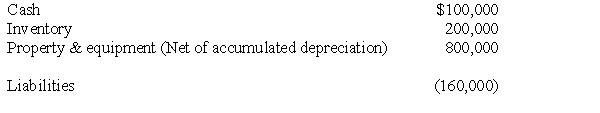

On May 1, 2016, the Phil Company paid $1,200,000 for 80% of the outstanding common stock of Sage Corporation in a transaction properly accounted for as an acquisition. The recorded assets and liabilities of Sage Corporation on May 1, 2016, follow:  On May 1, 2016, it was determined that the inventory of Sage had a fair value of $220,000 and the property and equipment (net) has a fair value of $1,200,000. What is the amount of goodwill resulting from the business combination?

On May 1, 2016, it was determined that the inventory of Sage had a fair value of $220,000 and the property and equipment (net) has a fair value of $1,200,000. What is the amount of goodwill resulting from the business combination?

Definitions:

Self-comparison

The act of evaluating oneself against the attributes, achievements, or aspects of others, often contributing to one's self-esteem and self-perception.

Self-handicapping

A cognitive strategy where individuals create obstacles or excuses for themselves to avoid blame in case of failure but can take credit in case of success.

Self-enhancement

The desire to maintain, increase, or portray one's self in a positive light to others and oneself.

Defensive Strategy

Tactics used by individuals or groups to protect themselves from perceived threats, criticism, or harmful situations.

Q5: The parent company concept adjusts subsidiary net

Q6: The translation adjustment that results from translating

Q8: On January 1, 2016, Pamela Company purchased

Q12: Push down accounting is an accounting method

Q18: On January 1, 2008, Perry Company purchased

Q20: P Corporation acquired 80% of S Corporation

Q28: Due to the fact that the partnership

Q32: The first step in estimating goodwill in

Q35: Determination of the noncontrolling interest in consolidated

Q171: The opportunity cost of every investment in