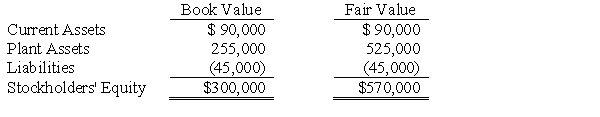

The managers of Savage Company own 10,000 of its 100,000 outstanding common shares. Swann Company is formed by the managers of Savage Company to take over Savage Company in a leveraged buyout. The managers contribute their shares in Savage Company and Swann Company then borrows $675,000 to purchase the remaining 90,000 shares of Savage Company for $600,000; the remaining $75,000 is used for working capital. Savage Company is then merged into Swann Company effective January 1, 2016. Data relevant to Savage Company immediately prior to the leveraged buyout follow:  Required:

Required:

A. Prepare journal entries on Swann Company's books to reflect the effects of the leveraged buyout.

B. Determine the balance of each of the following immediately after the merger:

1. Current Assets

2. Plant Assets

3. Note Payable

4. Common Stock

Definitions:

Values Clarification

A process of becoming more conscious of and naming what we value or consider important in life, often used in moral and career decision-making.

Risk Factor

An aspect of personal behavior or lifestyle, an environmental exposure, or a genetic characteristic that is associated with an increased occurrence of disease or injury.

Veracity

A moral principle that holds that people should tell the truth and not lie.

Painful Procedure

A medical or therapeutic intervention that causes discomfort or pain to the patient, often requiring specific pain management techniques.

Q7: Stock given as consideration for a business

Q15: The exchange rate quoted for future delivery

Q29: Which of the following is an example

Q30: In the area of many college campuses,

Q34: P Company sold merchandise costing $240,000 to

Q35: When the value implied by the purchase

Q51: At full employment, a society produces<br>A) somewhere

Q57: There is often only one major league

Q86: The presence of scarcity means that no

Q145: Nadine is considering the "dress well, test