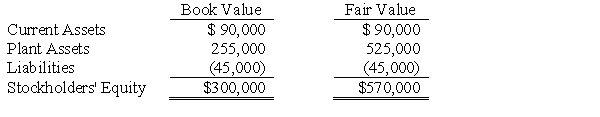

The managers of Savage Company own 10,000 of its 100,000 outstanding common shares. Swann Company is formed by the managers of Savage Company to take over Savage Company in a leveraged buyout. The managers contribute their shares in Savage Company and Swann Company then borrows $675,000 to purchase the remaining 90,000 shares of Savage Company for $600,000; the remaining $75,000 is used for working capital. Savage Company is then merged into Swann Company effective January 1, 2016. Data relevant to Savage Company immediately prior to the leveraged buyout follow:  Required:

Required:

A. Prepare journal entries on Swann Company's books to reflect the effects of the leveraged buyout.

B. Determine the balance of each of the following immediately after the merger:

1. Current Assets

2. Plant Assets

3. Note Payable

4. Common Stock

Definitions:

Check

A written, dated, and signed instrument that directs a bank to pay a specific sum of money to the bearer or a named party.

Budgets

Financial plans that outline an organization's revenue, expenditures, and investment strategies for a specific period.

Cash Inflows

The movement of money into an entity or business, typically arising from sales, investments, financing, and other business activities.

GAAP Standards

Generally Accepted Accounting Principles (GAAP) are a collection of commonly followed accounting rules and standards for financial reporting.

Q1: On November 1, 2017, American Company sold

Q2: In the preparation of a consolidated statement

Q10: What is DiNozzo's opportunity cost of making

Q15: SFAS No.162, the Accounting Standards Codification, is

Q16: In a leveraged buyout, the portion of

Q26: A 90% owned subsidiary sold merchandise at

Q28: If an entity is not considered a

Q45: Which of the following is both a

Q67: When the opportunity cost of producing a

Q105: A mother takes her daughter on an