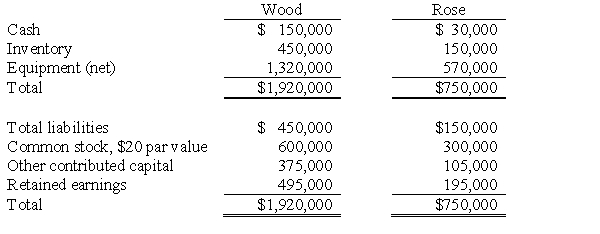

The following balance sheets were reported on January 1, 2016, for Wood Company and Rose Company:  Required:

Required:

Appraisals reveal that the inventory has a fair value $180,000, and the equipment has a current value of $615,000. The book value and fair value of liabilities are the same. Assuming that Wood Company wishes to acquire Rose for cash in an asset acquisition, determine the following cutoff amounts:

A. The purchase price above which Wood would record goodwill.

B. The purchase price at which Wood would record a $50,000 gain.

C. The purchase price below which Wood would obtain a "bargain."

D. The purchase price at which Wood would record $75,000 of goodwill.

Definitions:

Current Ratio

A financial metric used to evaluate a company's ability to pay short-term obligations, calculated by dividing current assets by current liabilities.

Fixed Asset Turnover

A financial ratio that measures how efficiently a company is using its fixed assets to generate sales.

Profit Margin

A financial metric used to evaluate a company's profitability, calculated as net income divided by revenue.

Net Fixed Assets

Assets with a physical form that are held by a company for long-term use, minus depreciation.

Q1: On January 1, 2016, Pamela Company purchased

Q1: Bjork, a calendar year company, has the

Q1: Noncontrolling interest in consolidated income is never

Q8: Accounting under IFRS and US GAAP is

Q18: Petunia Company acquired an 80% interest in

Q27: The noncontrolling interest's share of the selling

Q30: On January 1, 2016, P Corporation purchased

Q35: Prime Industries acquired an 80 percent interest

Q92: Suppose that during Coco's afternoon shift working

Q127: Is there an opportunity cost to increased