Use the following information to answer the following questions.

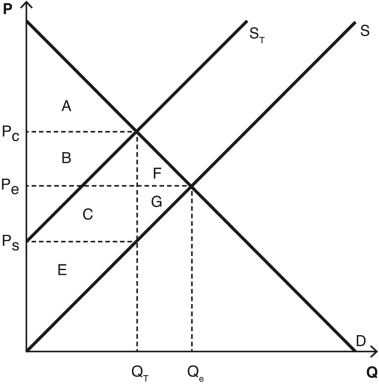

The following graph depicts a market where a tax has been imposed.Pe was the equilibrium price before the tax was imposed,and Qe was the equilibrium quantity.After the tax,PC is the price that consumers pay,and PS is the price that producers receive.QT units are sold after the tax is imposed.NOTE: The areas B and C are rectangles that are divided by the supply curve ST.Include both sections of those rectangles when choosing your answers.

-What is the total amount of producer and consumer surplus (i.e. ,social welfare) in this market before the tax is imposed?

Definitions:

Marginal Revenue

The supplementary income generated from the sale of an additional good or service by a firm.

Total Revenue

The entire amount of income generated by the sale of goods or services by a firm.

Market Price

The prevailing rate at which a product or service is available for purchase or sale in a market driven by competition.

Marginal Revenue

Marginal revenue is the additional income received from selling one more unit of a good or service.

Q1: The law of supply states that, all

Q49: The movie Saving Private Ryan is about

Q61: To avoid double counting when calculating gross

Q76: An economic downturn can lead to mainly

Q82: What does it mean when society is

Q99: Many states have laws that limit the

Q104: The usual purpose of an experiment is

Q121: What does economics research have to say

Q147: If the demand for bread is more

Q168: A(n) _in the elasticity of supply or