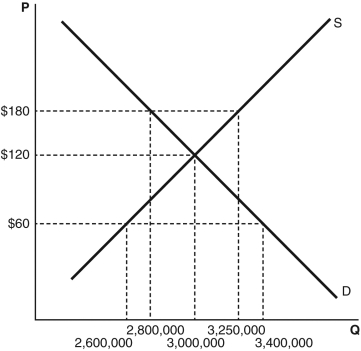

Refer to the accompanying figure to answer the following questions.

-If there is a $60 price ceiling imposed on a textbook,what will be the disequilibrium amount?

Definitions:

FICA Taxes

Taxes collected under the Federal Insurance Contributions Act that fund Social Security and Medicare programs.

Regressive

Pertaining to a tax system in which the tax rate decreases as the taxable amount increases, commonly considered less fair because it imposes a heavier burden relative to income on those with less.

Progressive

Pertaining to a taxation system in which the tax rate increases as the taxable amount increases, imposing a higher percentage rate on the wealthy to ensure equity.

Consumption Tax

A tax on the purchase of goods or services, levied at the point of sale, designed to tax spending rather than income or savings.

Q5: At what price level does the apartment

Q6: Explain two shortcomings of using the official

Q13: Which of the following statements is true

Q22: Which of the following is true, holding

Q33: Which point represents a new production possibility?<br>A)

Q37: Suppose Anthony lives in a community with

Q45: Which of the following is both a

Q84: In Felixania, cat food constitutes 45 percent

Q101: A tax on consumers of a good

Q133: Explain the difference between the burden of