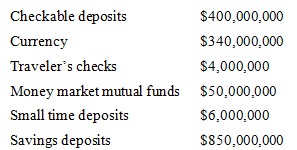

Refer to the following table to answer the following questions:

-Which of the following is NOT considered part of M2?

Definitions:

Progressive Tax

A taxation system where the tax rate increases as the taxable amount or income of the individual or entity increases.

Benefits-Received Principle

A taxation theory stating that individuals should pay taxes in proportion to the benefits they receive from government services.

Gasoline Tax

A levy imposed by governments on the sale of gasoline, often used to fund transportation infrastructure and environmental initiatives.

Corporate Income Tax

A tax on the profit of a corporation, where the tax rates can vary based on a country's tax laws and the company's income levels.

Q5: Holding all else constant, in the short

Q15: Suppose you are offered a job with

Q44: If St. John has a closed economy,

Q46: According to adaptive expectations theory, when inflation

Q86: What has happened to the real value

Q92: Which of the following is NOT an

Q120: If the interest rate on a loan

Q140: Which of the following is an example

Q142: By the principle of comparative advantage, Jameson

Q170: Graphically illustrate the deadweight loss that results