The following ratios have been computed for Southern Company for 2014. Profit margin ratio Times interest earned Accounts receivable turnover 20%12 times 5 times Current ratio Debt to assets ratio 2.5:124%

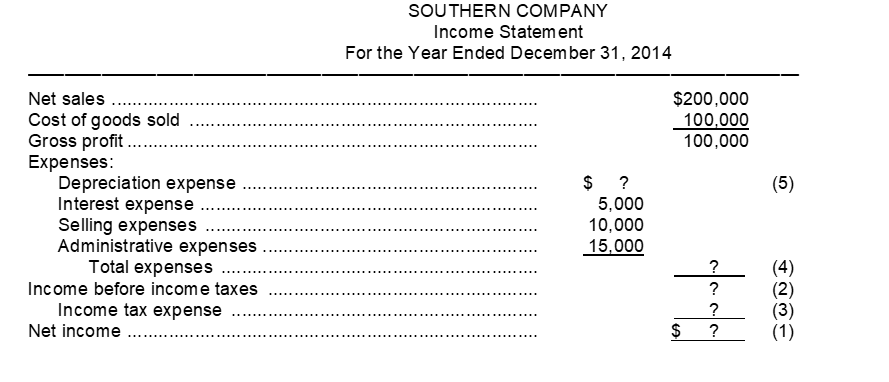

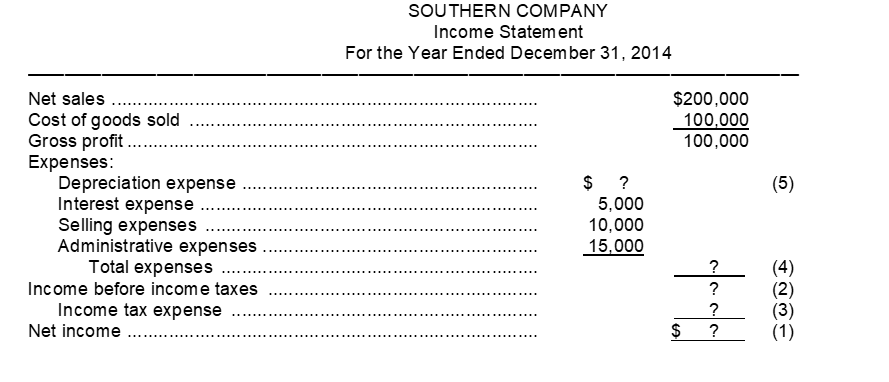

The 2014 financial statements for Southern Company with missing information follows:

SOUTHERN COMPANY Comparative Balance SheetDecember 31 . Assets Cash Debt Investments Accounts receivable (net) InventoryProperty, plant, and equipment (net) Total assets $25,00015,000?(6)?(7)200,000$?(8)$35,00015,00050,00050,000160,000$310,000

Instructions

Use the above ratios and information from the Southern Company financial statements to fill in the missing information on the financial statements. Follow the sequence indicated. Show computations that support your answers.

Calculate effective annual rates of return on investments such as Treasury bills.

Identify and compute various measures of investment performance, including Holding Period Return (HPR).

Understand the differences between arithmetic average return, geometric average return, and their implications for investment forecasting.

Grasp the concept of a complete portfolio and its components.

Definitions:

Responsibilities

Duties or tasks that an individual or entity is expected or required to perform or uphold.

Special Projects

Unique, temporary tasks or initiatives that require a dedicated team and resources to achieve specific goals.

Challenging Job Demands

Refers to work conditions that require high levels of effort and skill, which can be motivating but also stressful.

Workload

The amount of work that an individual or group is responsible for during a given time period.