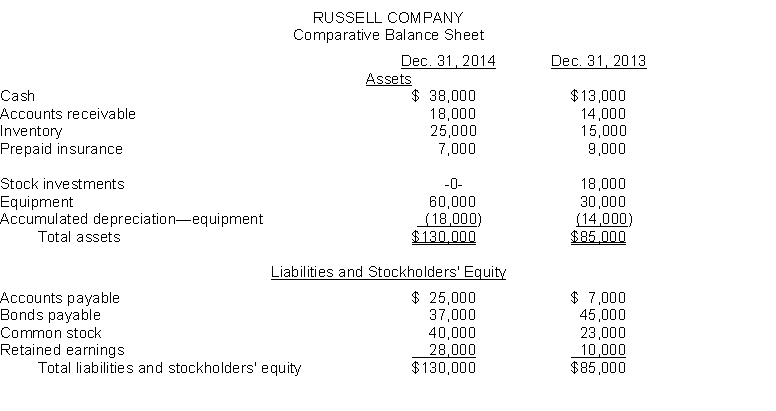

The comparative balance sheets for Russell Company appear below:

Additional information:

1. Net income for the year ending December 31, 2014, was $30,000.

2. Cash dividends of $12,000 were declared and paid during the year.

3. Stock investments that had a book value of $18,000 were sold for $13,000.

4. Sales for 2014 are $130,000.

Instructions

1. Prepare a statement of cash flows for the year ended December 31, 2014, using the indirect method.

2. Compute the following cash based ratios:

a. Current cash debt coverage

b. Cash debt coverage

Definitions:

Diminishes Value

Refers to any action or occurrence that lessens or reduces the worth or perceived worth of something, often used in legal and commercial contexts.

Governmental Taking

In law, the act of a government seizing private property for public use, often with compensation to the owner.

Unconstitutional Conditions

The principle that the government cannot condition the receipt of a government benefit or the ability to participate in a government program upon the waiver of a constitutionally protected right.

Just Compensation

Refers to the compensation or remuneration required by law to be paid to an individual whose property has been taken for public use, ensuring the payment is fair and adequate.

Q86: Anjili Company had credit sales of $1,400,000.

Q122: Income from operations appears on both the

Q129: Net sales are $2,400,000, beginning total assets

Q154: Lupton Inc. disposes of an unprofitable segment

Q155: Zoum Corporation had the following transactions during

Q156: Gross profit for a merchandising company is

Q172: The information in the following table

Q213: Which of the following items should be

Q236: Name at least three advantages of a

Q263: Which of the following statements is not