During 2014 Kenton Corporation had the following transactions and events:

1. Issued par value preferred stock for cash at par value

2. Issued par value common stock for cash at an amount greater than par value

3. Completed a 2 for 1 stock split in which the $10 par value common stock was changed to $5 par value stock

*4. Declared a small stock dividend when the market value was higher than the par value

5. Declared a cash dividend

*6. Issued the shares of common stock required by the stock dividend declaration in 4. above

7. Issued par value common stock for cash at par value

8. Paid the cash dividend

Instructions

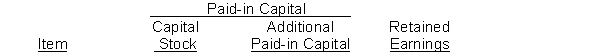

Indicate the effect(s) of each of the foregoing items on the subdivisions of stockholders' equity. Present your answers in tabular form with the following columns. Use (I) for increase, (D) for decrease, and (NE) for no effect.

Definitions:

Insurance Expense

The cost associated with purchasing insurance to protect against various risks, recorded as an expense.

Unearned Revenue

Money received by a company for goods or services yet to be provided. It is considered a liability until the service is delivered or the product is provided.

Investments

Assets purchased with the aim of generating income or appreciation, including securities, real estate, and other financial assets.

Wages Payable

A liability account that records the amount of unpaid wages earned by employees at the end of a reporting period.

Q10: Manning Company has $1,000,000 in assets and

Q21: The following data is available for

Q72: On October 1, Sam's Painting Service borrows

Q149: Ferman Corporation had net income of $160,000

Q170: In Jackson Jones Company, land decreased $180,000

Q185: The income statement for a merchandising company

Q246: Oxford Inc. was authorized to issue 100,000

Q249: The accounts receivable turnover is calculated by

Q262: Yanik Corporation issues 4,000, 10-year, 8%, $1,000

Q268: The amount of cost of good available