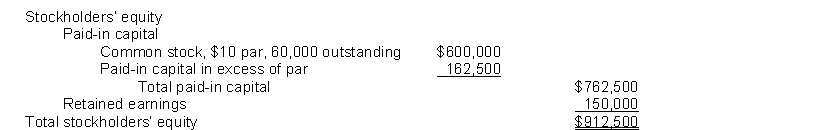

Giraldi Corporation's stockholders' equity section at December 31, 2013, appears below:

On June 30, 2014, the board of directors of Giraldi Corporation declared a 15% stock dividend, payable on July 31, 2014, to stockholders of record on July 15, 2014. The fair value of Giraldi Corporation's stock on June 30, 2014, was $16.

On December 1, 2013, the board of directors declared a 2 for 1 stock split effective December 15, 2014. Giraldi Corporation's stock was selling for $18 on December 1, 2014, before the stock split was declared. Par value of the stock was adjusted. Net income for 2014 was $230,000 and there were no cash dividends declared.

Instructions

(a) Prepare the journal entries on the appropriate dates to record the stock dividend and the stock split.

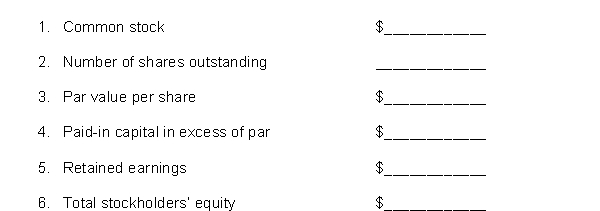

(b) Fill in the amount that would appear in the stockholders' equity section for Giraldi Corporation at December 31, 2014, for the following items:

Definitions:

Activity-Based Costing

An accounting technique that assigns costs to units based on the activities needed to produce or deliver them, enhancing costing accuracy.

Overhead Cost

Indirect costs related to the general operation of the company, such as rent, utilities, and management salaries, not directly tied to production or sales.

Unit

A single, complete, or individual item that can be counted for inventory, production, or sales purposes.

Unit Level Activities

Activities that are performed each time a unit is produced, directly associated with production volume.

Q18: Assets purchased for resale are recorded in

Q49: Colie Company had an increase in inventory

Q109: If net sales are $750,000 and cost

Q122: Laser Performance Inc. has the following

Q143: Sales taxes collected by a retailer are

Q156: Gross profit for a merchandising company is

Q171: Which one of the following items is

Q200: Freight-out appears as an operating expense in

Q270: If the inventory turnover is 7.3 times,

Q273: Inventory becomes part of cost of goods