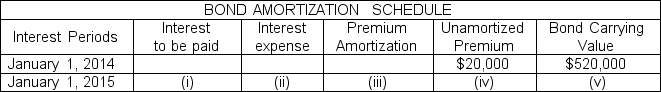

The following partial amortization schedule is available for Courtney Company who sold $500,000, five-year, 10% bonds on January 1, 2014 for $520,000 and uses annual straight-line amortization.  Which of the following amounts should be shown in cell (v) ?

Which of the following amounts should be shown in cell (v) ?

Definitions:

Privity of Contract

The relationship between parties in a contract that confers rights and obligations.

Individual

Referring to a single human being as distinct from a group, class, or family.

Contract

A legally binding agreement between two or more parties that outlines the terms and conditions of a particular arrangement.

Product Misuse

Product Misuse involves using a product in a way not intended by its manufacturer, which can lead to damages or injury not covered under warranties or liability claims.

Q21: Grand Company issued $800,000, 10%, 20-year bonds

Q44: A company sells a plant asset that

Q55: Under the periodic system, the purchases account

Q57: If bonds are issued at face value

Q60: A bank statement<br>A) lets a depositor know

Q62: Companies only dispose of plant assets by

Q69: When a bond sells at a discount,

Q119: Thayer Company purchased a building on January

Q198: A computer company has $3,000,000 in research

Q219: Selling the bonds at a premium has