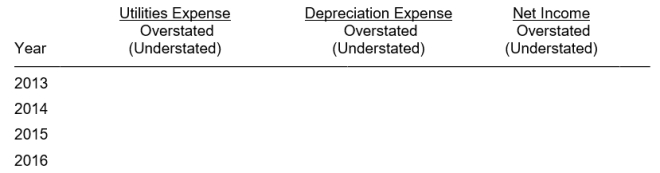

On January 1, 2012, Keller Company purchased and installed a telephone system at a cost of $20,000. The equipment was expected to last five years with a salvage value of $3,000. On January 1, 2013, more telephone equipment was purchased to tie-in with the current system for $10,000. The new equipment is expected to have a useful life of four years. Through an error, the new equipment was debited to Utilities Expense. Keller Company uses the straight-line method of depreciation.

Instructions

Prepare a schedule showing the effects of the error on Utilities Expense, Depreciation Expense, and Net Income for each year and in total beginning in 2013 through the useful life of the new equipment.

Definitions:

Bureaucratic Organizational Structure

An organizational model characterized by a hierarchy of authority, formalized rules and procedures, and impersonal relationships.

Flexible Organization Structure

Describes an organizational framework that can easily adapt to changes, allowing for modifications in structures and processes.

Horizontal Differentiation

The division of roles and responsibilities within an organization that focuses on the specialization and expertise of its members, rather than their rank or status.

Vertical Differentiation

The way an organization structures its hierarchy of authority, creating levels of management and rank within the company.

Q1: Discount on Bonds Payable is _ ("deducted

Q38: Burke Company purchases land for $90,000 cash.

Q91: Depreciation is the process of allocating the

Q96: In a recent year Hart Corporation had

Q176: Lowe Inc.'s bank statement from Western Bank

Q205: Delightful Discs has the following inventory data:

Q224: Identify whether each of the following items

Q234: Wishbone Company maintains two separate accounts payable

Q238: The _ price is equal to the

Q269: A legal document that indicates the name